The auditor must either express an opinion regarding the financial statements, taken as a whole, or state that an opinion cannot be expressed, in the auditor's report.When the auditor determines that informative disclosures are not reasonably adequate, the auditor must so state in the auditor's report.

#Three categories of generally accepted auditing standards professional#

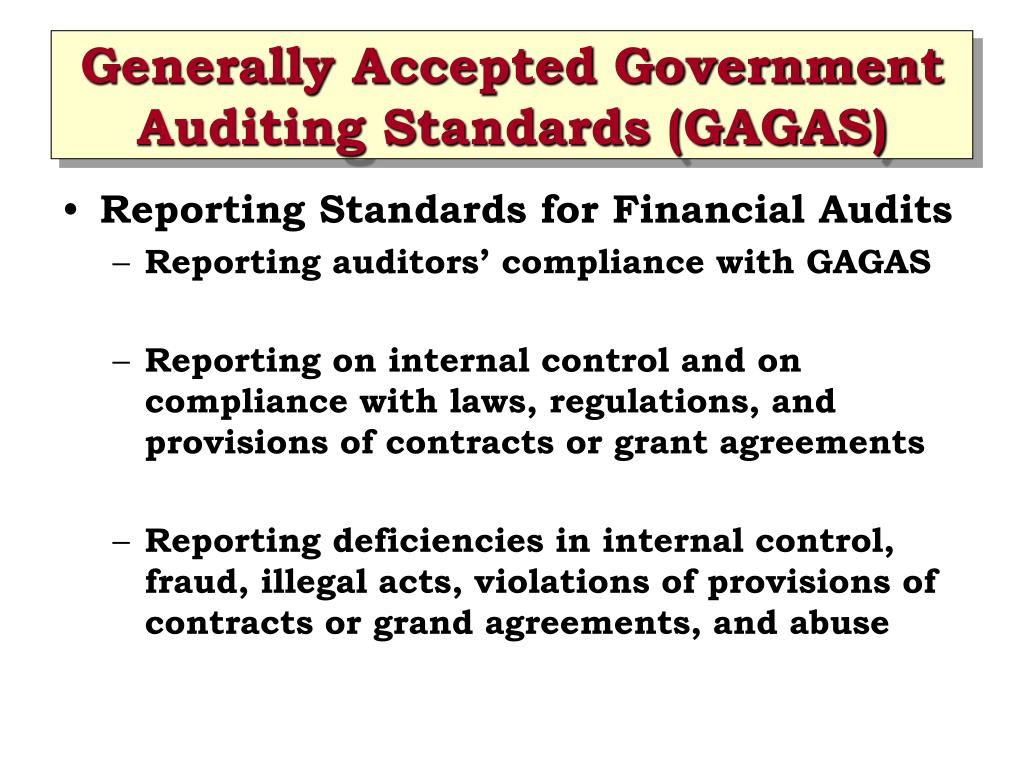

The GAAS continues to apply to non-public companies. In the United States, the Public Company Accounting Oversight Board develops standards (Auditing Standards or AS) for publicly traded companies since the 2002 passage of the Sarbanes–Oxley Act however, it adopted many of the GAAS initially. However, in 2012 the Clarity Project significantly revised the standards and replaced AU Section 150 with AU Section 200, which does not explicitly discuss the 10 standards. Typically, the first number of the AU section refers to which standard applies. These standards are issued and clarified Statements of Accounting Standards, with the first issued in 1972 to replace previous guidance. In the United States, the standards are promulgated by the Auditing Standards Board, a division of the American Institute of Certified Public Accountants (AICPA).ĪU Section 150 states that there are ten standards: three general standards, three fieldwork standards, and four reporting standards. Several organizations have developed such sets of principles, which vary by territory. These inspections include an evaluation of the CPA firm's system of quality control.Generally Accepted Auditing Standards, or GAAS are sets of standards against which the quality of audits are performed and may be judged. Section 104 of the Sarbanes-Oxley Act of 2002 requires the PCAOB to conduct inspections of public accounting firms to assess compliance with SOX, the PCAOB, the SEC, and professional standards related to audits of public companies. Peer reviews now are more closely associated with CPA firms not involved with audits of publicly held entities, due to the enactment of the Sarbanes-Oxley Act of 2002. The review is carried out by CPAs from another firm or by a committee of CPAs from several firms.

Unless a firm has a peer review, all members of the CPA firm may lose their eligibility for AICPA membership. The purpose of the review, which is also called practice-monitoring, is to determine whether the CPA firm has developed adequate policies and procedures for the five elements of quality control and actually follows them in practice. A peer review is the review of a CPA firm's compliance with its quality control system.

0 kommentar(er)

0 kommentar(er)